Table of Contents

Goods Transportation in India

The Indian trucking industry is experiencing a significant boom, with an estimated 4.6 billion tonnes of freight transported annually. As this vital sector continues to grow, it’s important for truck owners and businesses that rely on trucking services to stay informed about the Goods and Services Tax (GST). This blog serves as your guide to understand how GST applies for both Goods Transport Agency (GTA) and truck owners. We’ll explore the different rates, schemes, and exemptions available, helping you navigate the system efficiently and ensure smooth business operations. But before we go into this topic let’s understand the meaning of GST:

What is GST?

GST stands for Goods and Services Tax. It’s a comprehensive indirect tax levied in India on the supply of goods and services. Registration isn’t mandatory for everyone. But it applies to businesses if their turnover exceeds a certain limit. Here’s a general guideline:

- Normal States: Businesses with an annual turnover exceeding Rs. 40 lakh need to register for GST.

- Special Category States: In North-Eastern and some hilly states, the registration limit is lower, at Rs. 10 lakh annually.

I. GST for Goods Transport Agency

GTA Meaning (Goods Transport Agency)

GTA full form: Goods Transport Agency

Central Tax (Rate) dated 28/06/2017 defines Goods Transport Agency (GTA) as a company that transports goods by road and issues a receipt, known as a consignment note.

In other words, the Goods Transport Agency (GTA) refers to a business that arranges the transportation of goods from one place to another. GTAs act as intermediaries, connecting shippers with carriers (trucking companies, railways, etc.) and handling logistics like documentation and insurance.

GTA services under GST

The following are the GTA services under GST:

- Issuing consignment notes, which are crucial documents for tracking goods.

- Arranging for packing, loading, unloading, and storage (if needed).

- Ensuring the safe and timely delivery of goods.

- Handling paperwork and documentation for the shipment.

Consignment note under GST

The Goods Transport Agency (GTA) is responsible for issuing the consignment note upon receiving the goods for transportation. It’s usually a serially numbered document with copies distributed to the consignor, consignee, and the transporter for record-keeping purposes.

A consignment note under GST is a key document. It’s like a receipt for your goods, outlining:

- Who’s sending (consignor) and receiving (consignee) the goods

- What’s being shipped (details and quantity)

- Where it’s going (origin and destination)

- Who should pay GST (consignor/ consignee/ GTA)

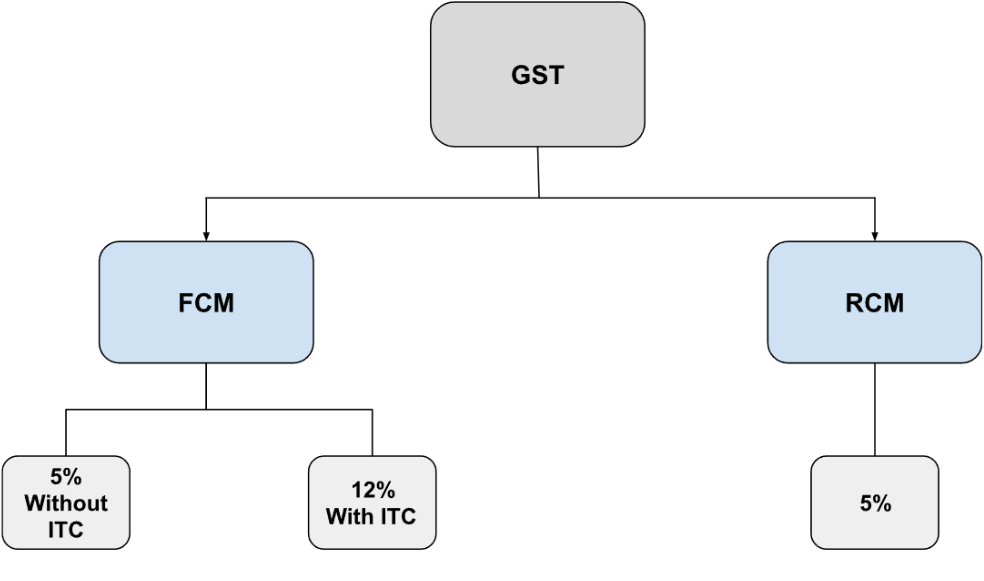

What is the GST Rate on GTA?

The services provided by a registered GTA attract GST. The responsibility of paying GST can fall on either the GTA or the recipient, depending on the situation.

Forward Charge Mechanism on GTA services

Under the forward charge mechanism, the goods transport agency itself pays the GST on transport services it provides. This gives the GTA more control over the tax burden and allows them to claim Input Tax Credit (ITC) on eligible purchases related to their transportation business (fuel, vehicle maintenance, etc.). However, there are two options under forward charge:

1. 5% GST without ITC:

- This option is simpler, as the GTA simply charges the recipient 5% GST on the service and pays it to the government.

- However, the downside is that the GTA cannot claim ITC on any purchases related to their business, which might increase overall costs.

2. 12% GST with ITC:

- This option allows the GTA to claim ITC on eligible purchases, potentially reducing their overall tax liability.

- However, the GTA has to charge the recipient a higher GST rate (12%) and maintain detailed records for claiming ITC.

Returns to be filed by GTA

- GSTR-1 (Sales): This return needs to be filed monthly or quarterly (depending on the turnover) and details all outward supplies (transportation services) made by the GTA.

- GSTR-3B (Summary & Tax Liability): This return is filed monthly or quarterly and summarizes the tax liability based on GSTR-1 and other GST transactions.

- GSTR-9 (Annual Return): This is an annual return filed by all GST-registered businesses and provides a comprehensive overview of their transactions for the financial year.

Reverse Charge Mechanism (RCM) on GTA services

Under the RCM, the GST on transport services is payable by the recipient. The recipient pays a flat 5% GST on the service value. This usually happens when the recipient falls under specific categories, such as:

- Factories under Factories Act, 1948

- Societies under Societies Registration Act

- Co-operative societies

- Body corporates (companies, PSUs)

- Partnership firms (registered/unregistered)

- Any GST-registered business

- Casual taxable persons

Returns to be filed by GTA

The goods transport agency does not need to file GSTR-1 or GSTR-3B in this case, as they are not directly paying the GST. However, they might still need to file GSTR-9 depending on their overall GST transactions for the year.

GTA Exemption Under GST

Exemption Based on Specific Goods:

- Agricultural produce (to incentivize agricultural activity)

- Milk, salt & food grains (considered essential items)

- Organic manure (to promote sustainable practices)

- Defense or military equipment (for national security)

- Newspapers or magazines (to ensure free flow of information)

- Relief materials (to support disaster relief efforts)

Exemption Based on Transaction Value:

- Low-Value Goods: When the total charges for transporting a single consignment within a single carriage do not exceed Rs.1,500, the service is exempt from GST.

- Consolidated Consignments: If the total consideration charged for transporting all goods to a single consignee (receiver) is less than Rs. 750, it’s exempt from GST.

Exemption Based on Entity Involved:

- Government Departments: Departments and establishments of the central and state government, along with local authorities and governmental agencies, are exempt from GST on GTA services.

II. GST for Truck Owners/Small fleet owners

In India, Goods and Services Tax (GST) applies to almost everything you buy, including trucks. So when you buy a new truck, you will pay additional GST (28%) for it. For example, if you buy a truck for Rs.40 lakhs, you will be paying additional Rs.11,20,000 as GST. But the good news is that you could claim the amount paid as ITC.

As a truck owner or a small fleet owner, you would fall under any of the following categories:

1. Operating the Truck Yourself

Registered Business (FCM): If you are a registered business, you’ll fall under the Forward Charge Mechanism (FCM). This means you’ll be responsible for collecting and depositing the collected GST with the government. The GST rate is 12% and you can avail Input tax credit as well.

Unregistered Business (RCM): If you are not registered for GST, you might fall under the Reverse Charge Mechanism (RCM) in certain situations. This applies when you avail services from a larger company registered under GST. In this case shippers pay 5% for taxable goods.

2. Renting the Truck to a Goods Transport Agency (GTA)

Renting a truck to a GTA is exempt from GST. This applies even if the owner is a registered GST business. In this case the truck owner or small fleet owner wouldn’t collect or pay any GST on the rental service.

Summary of GST on GTA and Truck Owners

| Scenario | FCM (Forward Charge Mechanism) | RCM (Reverse Charge Mechanism) |

| GTA / Large fleet owners | 12% with Input tax credit | Shippers pay 5% for taxable goods |

| Small fleet owners renting to GTA | Not Applicable (Exempt) | Not Applicable (Exempt) |

| Small fleet owners renting to shippers directly (not through a GTA) | 12% with Input tax credit. But most tax owners will not have GST registration and hence do not opt for FCM | Shippers pay 5% for taxable goods |

Conclusion

As a truck owner or a Goods Transport Agency (GTA), you’re part of this vital network. Understanding GST empowers you to navigate the system efficiently, ensuring a smooth road ahead for your business. Remember, for a deeper dive into the specifics of goods transport agency under GST or your situation, consulting a tax advisor familiar with the trucking industry is always recommended.

Yoga Laxmi

Sometimes English is just silly. That's what got me hooked on writing in the first place. Why on earth can't "grateful" be spelled "greatful"? Here's the thing, I love untangling the knots of language just as much as I love untangling the complexities of logistics. In my blog posts, I'll do both! No "greatful" mistakes here, just good info and a smooth journey through the world of shipping.